Electroindustry Business Conditions Index (EBCI)

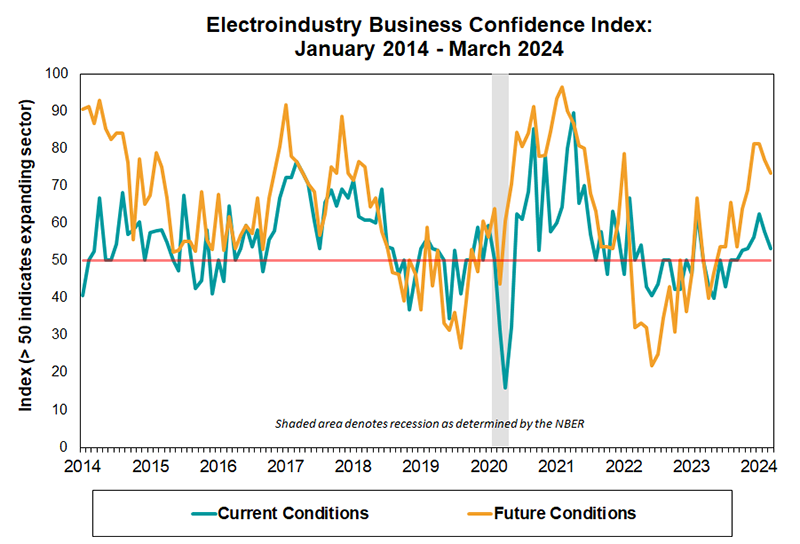

The EBCI indices are based on the results of a monthly survey of senior managers at NEMA Member companies and are designed to provide a measure of changes in the business environment facing electrical equipment manufacturers.

For more information,

e-mail NEMA Business Information Services.

March 2024

Please note that survey responses were collected from the period of March 11-22, 2024.

(Rosslyn, VA) In February just over half (54%) of panel members reported “unchanged” conditions. That number increased to 67 percent in March. The increase of respondents reporting “unchanged” conditions led to a decrease in the current conditions component to 53.5 points in March, down from the previous month’s 57.7. The member comments were mixed but focused on stability. Members mentioned stable conditions and no significant changes. Some comments noted mega projects continuing and quotations still at record levels, with the caveat that incoming orders have slowed due to excessive inventory levels.  EBCI results 202403nm

EBCI results 202403nm

February 2024

The shift in the share of respondents reporting

“unchanged” to “worse” conditions led to a decrease in the current conditions

component to 57.7 points in February, down from the previous month’s 62.5.

After having expanded for four consecutive months, the current conditions

reading still stands at its second highest point since February 2023. Although

the quantitative score declined, the member comments, similar to last month

were mixed, largely reflecting stability. Panel members mentioned large data

center projects in the coming months, and solid orders activity in the first

quarter, but at least one respondent noted concern about rising supply chain

disruptions.  EBCI results 202402nm

EBCI results 202402nm

January 2024

A

sharp falloff in the share of respondents reporting “worse” conditions helped

propel the current conditions component to 62.5 points in January, up from the

previous month’s 56.3. Having expanded for four consecutive months, the current

conditions reading stands at its highest point since February 2023. Although the

quantitative score was firmly in expansionary territory, and accelerating,

panel member comments were lukewarm, largely reflecting stability rather than

strong growth. Alluding to the mixed, but generally improving business

environment, one respondent noted that, “the residential market is the only

concern at this point…”  EBCI results 202401nm

EBCI results 202401nm