November/December 2021 | Vol. 26 No.6

by Fred Ashton, Senior Economist, NEMA

Quickly following the Covid-19 lockdowns that began in early 2020, manufacturers

were overwhelmed with a surge in demand for goods as the service sector was primarily closed to consumers. This shift in spending habits has ebbed somewhat in recent months as the economy reopened, but manufacturers still face heightened demand. Backlogs in production, estimated to last well into 2022, could prolong the continued recovery as wholesalers and retailers struggle to restock inventories.

Growth in the manufacturing sector should exceed overall economic growth through 2023. This bodes well for several products within the NEMA scope, specifically products included in the Industrial Products and Systems Division. The manufacturing sector is estimated to account for nearly 70 percent of the end market.

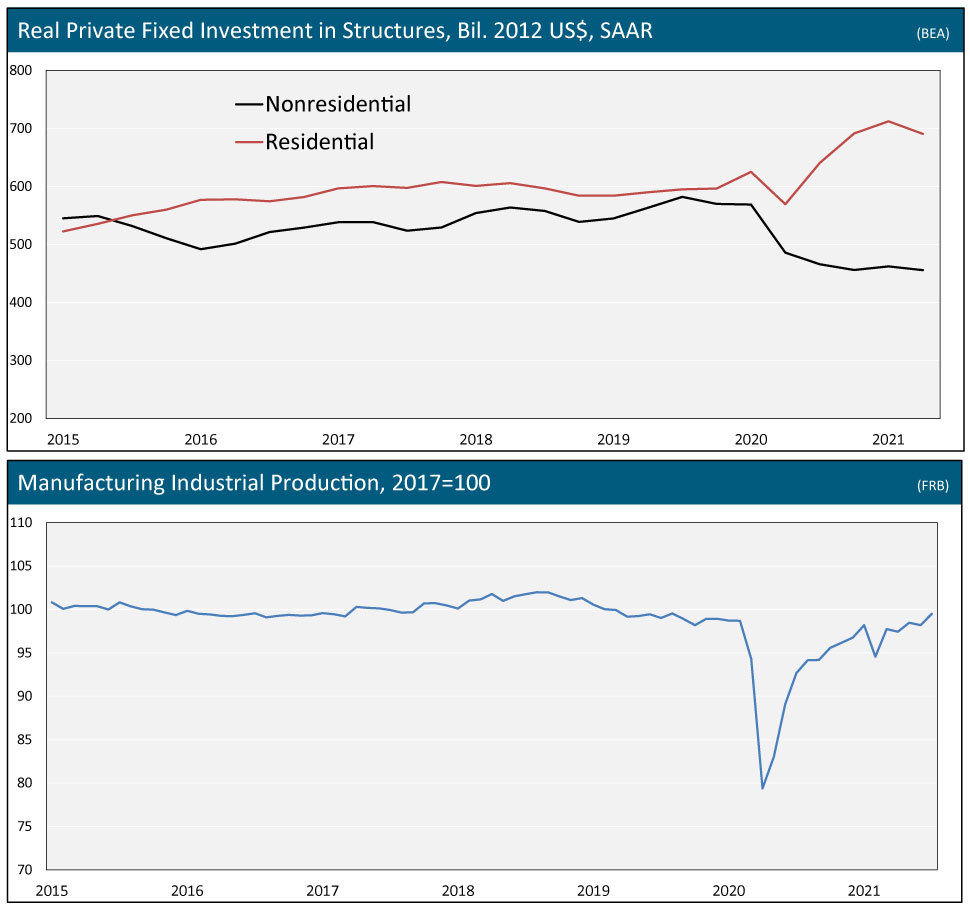

Meanwhile, the construction sector is more of a mixed story. Shortly after the initial Covid-19 lockdowns, residential construction emerged as a leader in the economic recovery. Low mortgage rates and a change in consumer preferences away from cities toward suburbs boosted demand for new construction. Real fixed investment in single-family homes swelled from $211 billion at a seasonally adjusted annual rate in the final quarter of 2019 to more than $260 billion in the second quarter of 2021. Overall spending on residential construction, which includes improvements and multi-family housing, increased from $596 billion to $690 billion over the same period. While a near-term peak for housing may have been reached as construction costs and input materials have soared, home improvement projects such as upgrading heating, ventilation, air conditioning (HVAC) systems, and other home appliances will support ongoing spending.

Conversely, real fixed investment in nonresidential structures continued to struggle. In the fourth quarter of 2019, investment measured $570 billion. There has been a lack of clarity on how the economy will operate in the future. Consequently, nonresidential investment has steadily declined to just over $450 billion at an annualized rate in the second quarter of 2021.

Recent infrastructure legislation includes planned spending on updates to the electrical grid, water treatment facilities, and other large infrastructure projects, which could alleviate some of the recent declines in the nonresidential construction end market. However, spending on these projects is unlikely to begin before 2023 at the soonest.

Both the manufacturing and construction end markets face mounting headwinds in the near term. The overall economic outlook for the second half of 2021 has deteriorated as the impact of the Delta strain of Covid-19 has compounded problems hiring and sourcing supplies. Additionally, recent elevated inflation could force the Federal Reserve to act sooner than expected to slow its support of the economy. While continued economic growth is likely, much depends on a smooth transition in Federal policy and avoiding. ei